insight2impact (i2i) has conducted a systematic review of behaviourally informed interventions that have significantly impacted the financial decisions of individuals as they engage with credit, savings, payment and insurance products (excluding health insurance).

We identified 18 interventions evaluated in 97 studies (comprisinging 124 experiments) through lab or field experiments across more than 30 countries. The results from these experiments provide us with important insights into the unconscious factors that influence the financial decisions of people.

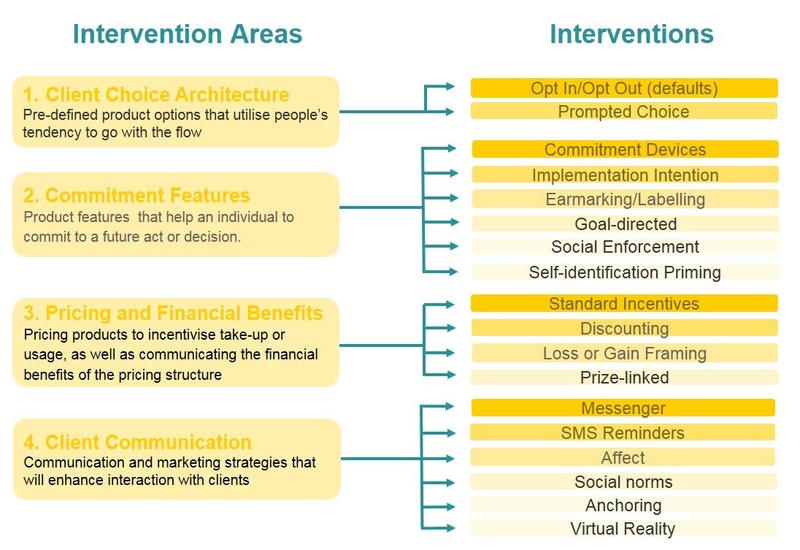

We focused on interventions that practitioners can reasonably implement. For ease of references these are categorised in four categories: (1) customer choice architecture; (2) commitment features; (3) product pricing and financial benefits and (4) customer communication. To see the associated papers in each category, visit i2i’s interactive Behavioural Interventions database.

The interventions associated with each category are as follows:

1. Client choice architecture

How providers present product options to customers influences what decisions they make, or maybe more correctly don’t make.

- Default, opt-in/opt-out. Provider pre-selected product options (e.g. savings contributions levels) that will prevail unless the consumer selects alternative.

- Prompted choice. Customers are prompted to make an active choice (e.g. monthly loan repayment amount) rather than being provided a default option.

2. Commitment features

Financial providers can build hard or soft commitment into the sales process or product features. Hard commitments are ones that cannot easily be reversed – an example is having a savings account that does not allow withdrawals. Soft commitments, on the other hand, are less stringent and allow one more flexibility – for example, making a verbal promise.

- Implementation intention. If-then plan that specifies the intended behaviour at a specific time and place (e.g. when I get my salary on Friday I will deposit 10% into my savings account)

- Goal-directed. Selection of a pre-defined goal (e.g. repayment date, savings amount)

- Commitment devices. Restricts or disincentives a set of possible future choices (e.g. early savings withdrawal penalty fee or restricts access to payday loans on Friday evenings)

- Labelling/earmarking. Labelling financial services products for an intended purpose (e.g. education or holiday savings)

- Self-identification priming. Making the identity of the decision-maker salient to both the decision-maker and financial services providers (e.g. the use of unique identifiers, such as biometrics, when originating a loan).

- Social enforcement. Making the financial decision of the individual known to peers or social networks (e.g. inform peer when loan is repaid).

3. Product pricing and financial benefits

Pricing and financial benefits allow FSPs to encourage customers to take-up a financial service and incentivise specific usage behaviours. While financial incentives are not novel, behavioural science gives new insights to how these can be more effectively applied.

- Standard incentives. Monetary and non-monetary incentives to promote or discourage behaviour (e.g. transport voucher for every bank account opened)

- Prize-linked. A lottery confers a prize to a financial services account holder if they meet certain conditions. (e.g. individuals are eligible for a USD 5,000 monthly lottery if they deposit more than USD 100 into their savings accounts)

- Discounting. Providing the product or product feature at a discounted rate (e.g. 50% reduction in insurance premiums)

- Loss or gain framing. Phrasing an outcome in terms of negative (loss) or positive (gain) features (e.g. stating the interest charges saved (gain frame) when paying higher monthly repayments on outstanding credit)

4. Customer communication

Providers communicate frequently with their customer during sales and servicing interactions however they often don’t consider how the communication may impact on the financial decisions of the customer.

- Messenger effect. Selecting a credible or relatable messenger (e.g. employer advises on pension contribution)

- SMS reminders. Messages delivered to a customer's mobile phone (e.g. Remember to pay your outstanding loan this month)

- Anchoring. A reference point communicated to the customer (e.g. minimum monthly repayments on your credit card)

- Affect. Soliciting an emotional response from the customer (e.g. advertising material makes use of aspirational images to position a credit or savings product)

- Social norms. Making the customer aware of the average behaviour or the behaviour of a reference group (e.g. the average pensions’ contribution in your organisation is 15%)

- Virtual reality. Using a virtual reality headset to convey information to client during a financial decision.

To see how these interventions have been implemented, please visit our behavioural interventions database. For more information on our behavioural research please contact herman@cenfri.org