Micro-, small and medium-sized enterprises (MSMEs) play a key role in economic development, but they face challenges in accessing finance.

In Uganda alone (as in most other sub-Saharan African countries), MSMEs account for approximately 90% of private-sector production, over 80% of manufactured output and 18% of GDP contribution (National Small Business Survey of Uganda, 2015; Ministry of Trade, Industry and Cooperatives, 2015). An estimated 84% of the 980,000 enterprises in Uganda fall into the micro category (Singh, 2017). Yet, five out of every 10 MSMEs do not use formal financial services, and three-quarters of them have existed for five years or less. This illustrates that the majority of MSMEs in Uganda have a short lifespan. MSMEs in Uganda indicated that a lack of access to finance is a primary constraint to their growth, with only 41% of them having ever applied for a loan (National Small Business Survey of Uganda, 2015). Very few of these MSMEs access credit from formal providers. In 2013, 34% of them accessed credit from informal institutions and 16% from friends and family, while 52% were excluded from credit (FinScope Uganda, 2013). This case study examines a fintech that is likely to address some of these challenges.

About the company: Smart Business Intelligence*

Smart Business Intelligence is a Uganda-based fintech company that supports MSMEs in automating and optimising their operations. Its product, MYAccounts, is reputedly the world’s first mobile-money integrated accounting solution, which reconciles mobile-money transactions to merchant statements in real time. MYAccounts aims to empower MSMEs with the tools to start, manage and grow their businesses to improve livelihoods and ultimately contribute to economic development across the sub-Saharan region.

By November 2017, about 3,500 MSMEs had signed up for MYAccounts (Smart Business Intelligence, 2017). The MSMEs served by Smart Business Intelligence reported earnings of between USD1,000 and USD7,000 per month and operated in sectors ranging from agriculture to manufacturing to fast-moving consumer goods.

About the product: MYAccounts

Traditional accounting tools are neither accessible to nor designed for MSMEs. MSMEs often face IT-related challenges such as the lack of access to computers, the internet and traditional accounting software. In the recent National Small Business Survey of Uganda, 62% of MSMEs surveyed reported that they keep physical receipts in an organised manner, but only 28% reported that they do full financials (revenue, expenses and tax accounting). Furthermore, while 52% of MSMEs stated that they manage their cash flow through bank accounts, a large share (30%) reported that they predominately manage their finances on a purely cash basis (National Small Business Survey of Uganda, 2015).

MYAccounts is a low-cost, mobile-based tool that allows MSMEs to record their transactions in a simple, easy-to-use way and that automatically generates full financial reports for them. Any cash received or sent to their merchant account is automatically reconciled to the respective accounts, such as sales, purchases or inventory expenses. Cash transactions are recorded manually. The tool allows users to track and account for every customer and for every supplier payment made to their business. This database of transactions is used to produce complete financial and stock records, including customer invoices, receipts, printable financial statements and tax returns. 55% of MSMEs in Uganda report that they use mobile money (National Small Business Survey of Uganda, 2015). This illustrates the importance of providing a mobile-money integrated solution.

The MYAccounts dashboard performs all the number crunching for the MSMEs, and they use visuals that are easy to engage with, such as bar charts and pie graphs. This allows MSMEs to identify gaps in the market, synchronise production, plan their sourcing and storage, and increase sales.

Smart Business Intelligence has coupled the digitisation of financial records with a business skills and empowerment programme. The aim of the training is to help MSMEs create actionable insights. Accounting advisers and the MSMEs work together to develop a schedule in which the advisers check in and provide training to the MSMEs on a continual basis. The accounting

advisers also encourage the MSME owner to open a mobile-money merchant account. These accounts have lower costs and allow MSMEs to clearly distinguish between personal transactions and business transactions – something that is frequently overlooked by MSMEs. In-person workshops, specialised seminars and localised handbooks on a variety of topics (such as tax, accounting, company law and system use) are offered to MSMEs that have subscribed to MYAccounts. Digitisation of their financial records and business training allows MSMEs to better understand their own business and to make business decisions based on sound financial records. This business skills training component of MYAccounts is seen as critical to its success as many MSMEs have indicated that is one of the factors that have made them to continue to use the product.

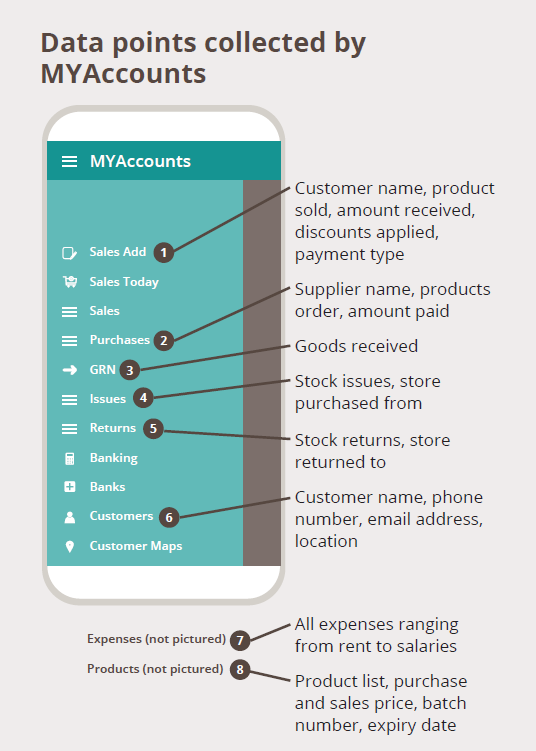

Wealth of data collected. The visual below depicts the interface of MYAccounts, and it outlines the data points that are collected through each app feature.

How can this product lead to improved access to financial services?

Digitising financial records to make the “invisible” visible. As typical Ugandan MSMEs do not employ traditional or digital accounting practices, and therefore often lack formal financial records, formal credit providers typically won’t consider them as potential customers. However, formal credit providers could use the digital financial records produced through MYAccounts to assess the risk associated with having the MSMEs as their customers. Additionally, MYAccounts may serve as powerful input into product development and service delivery strategies, as the data it produces gives insight into MSMEs’ financial records, services usage patterns and behaviour. Ultimately, the digitisation of financial records through MYAccounts has the potential to lead to more formal credit being extended to MSMEs and products and services being designed to better meet this segment’s needs.

Empowering MSMEs to make business decisions informed by data. To make informed business decisions, to manage the business’s cash flow and thus to be successful, it is imperative for MSMEs to have a holistic view of their financial records. MYaccounts automates the process of keeping financial records, and digitisation stores the records in digital form, which in turn can improve the quality of the records, reduce the administrative burden and lead to more data-driven decision- making. MYAccounts’s full financial reports, coupled with its education and empowerment programme, help MSMEs to better understand their businesses. Making decisions that are informed by accurate and real-time data can help MSMEs to overcome some of the challenges and complexities in running and growing their businesses.

*Known as “#KillerAnalytics” in DataHack4FI Season 1

References

FinScope Uganda. (2013). Available at: http://www.i2ifacility.org/data-portal/UGA

Ministry of Trade, Industry and Cooperatives. (2015). Uganda Micro, Small and Medium Enterprise (MSME) Policy. Available at: https://www.ugandainvest.go.ug/wp-content/uploads/2016/02/Final-MSME-Policy-July-2015.pdf

National Small Business Survey of Uganda. (2015). Available at: http://fsduganda.or.ug/uganda-national-small-business-survey-report/

Singh, A. (2017, March). MSME Finance in Uganda - Status and Opportunities for Financial Institutions. Available at: http://www.microsave.net/files/pdf/BN_169_MSME_Finance_in_Uganda_Status_and_Opportunities_for_Financial_Istitutions.pdf

Smart Business Intelligence, 2017. Available at: http://sbintell.com

Download print version (2.32 MB)

Click here for more information on the DataHack4FI Innovation Competition