One could be forgiven for thinking that Micro, Small and Medium businesses (MSMEs) - [equally referred to as SMMEs] in South Africa have many avenues of support and relief from the government in light of Covid-19 and 2021 unrests announcement1 by Treasury unveiling R38 billion package through Sasria. At the dawn of Covid-19, the same government announced support for MSMEs through the Department of Small Businesses (DSBD). In the DSBD close-out report, one can truly understand that though the government has well put a number of mechanisms in place to support MSMEs, it only projects a silhouette of safety nets not used. The saying goes: "the road to hell is paved with good intentions".

The Social unrest in Gauteng and KwaZulu Natal

South Africa experienced a series of unexpected social unrest that saw many township and informal businesses destroyed or looted and malls burnt. It was like a scene from a violent movie, which graduated to loss of lives in some instances.

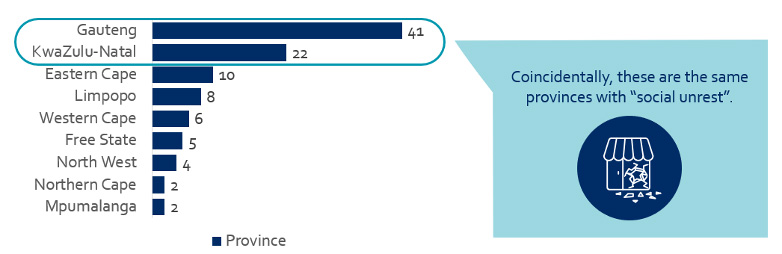

These two provinces account for 63% of all MSMEs in South Africa, which coincidentally happened to be the provinces that experienced social unrest.

Figure 1: The distribution of MSMEs in South Africa by province (in %)

Source: FinScope MSME South Africa 2020 Survey

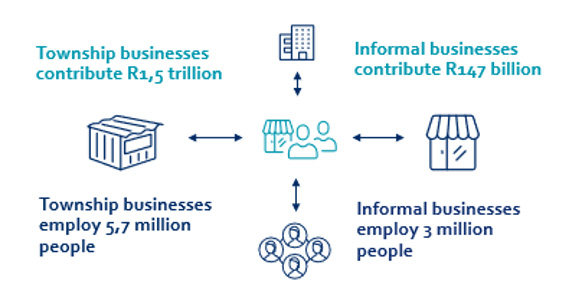

What was never understood before the unrest is the role of the township businesses, which contribute a good R1,5 trillion to GDP and employ 5,7 million people. This justifies the government's intention to bail out these MSMEs. However, the information that was not considered was that these MSMEs did not have the required documentation to be eligible for the grant.

Figure 2: Township and informal businesses employment and contribution to GDP

Source: FinScope MSME South Africa 2020 Survey

At the core of this mismatch between MSMEs and their ability to access support, no one had a full sense of the realities of MSMEs in South Africa. The FinScope MSME 2020 report provided a needed and timely set of information to close this information gap highlighting how unregistered and uninsured MSME plight is worsened by both pandemic and/or unrest in Gauteng and KwaZulu Natal - discussing only the two major threats that MSMEs were faced with recently, i.e. Covid-19 and the recent social unrest in Gauteng and KwaZulu Natal. What is misunderstood is the characteristics of these MSMEs that government purports to assist. The major findings from the FinScope MSME 2020 survey were that only 30% of the MSMEs are formally registered with SARS, with a further 7% registered with CIPC only - thus, 37% could be deemed as formal enterprises. This 37% is from a pool of 2,6 million businesses.

Covid-19 relief packages

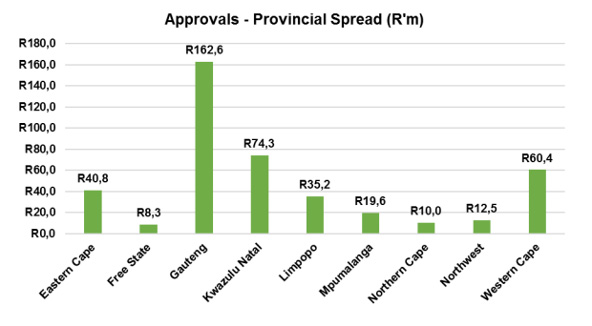

What started like "a winner" quickly dwindled out to the realisation that the total of R513 million of the relief grant went only to 1 497 MSMEs, with Gauteng and KwaZulu Natal accounting for most of the benefits with R162,6 million and R74,3 million, respectively.

Figure 3: Approvals - Provincial Spread (R millions)

Source: Dept of Small Business Development - SMME Relief Closeout Report 2020 2

The relief provided was a drop in the ocean of more than 2,6 million MSMEs. Why was this the case?

Three critical aspects come to light:

- Lack of required documentation, including documents from SARS, CIPC, and 3 months bank statements, remains a challenge with most MSMEs. FinScope MSME SA 2020 Survey reveals that most of these MSMEs are informal (63%). On the bank statements front, the survey further shows that around 81% of the MSMEs have a bank account, but 70% of these bank accounts are in the name of the business owner, which results in a complicated process for any person to use these bank account statement to access these relief packages.

- MSMEs had to prove that they suffered loss directly or indirectly from COVID and the riots. With only 33% of all MSMEs insured, most insurance policies are taken up in the business owner's name, thus making it difficult to prove business losses.

- Small business owners are not aware of these relief packages - the FinScope MSME SA 2020 reveals a disturbing picture as more than 63% of business owners reported a lack of awareness of organisations supporting MSMEs. With the R38 billion package that was announced in August 2021, it will mean that only a handful of MSMEs will utilise these funds.

Now that the challenges have been outlined, it begs the question: what could be done to close the loop? Simple and direct solutions are usually the best and easy to implement. A few suggestions could include:

- Create a national database of MSMEs. Within the database, data about the levels of formalisation businesses are at, detailed records about those businesses may be a winning move. This may prove challenging but necessary, and the informal should not be excluded. However, compliance with registration will be challenging to achieve as MSMEs may not want to deal with the increased effort and perhaps taxes that come with formalisation and compliance.

- Stringent requirements. A tiered approach can be developed since MSMEs are at different life stages, development and require a tailored approach similar to what 'tiered Know Your Customer frameworks' employ.

- Challenge of lack of awareness. Strengthen communication so MSMEs have an idea and information about where to seek guidance, aid and mentoring. This should include information on how to register and protect the business effectively.