There is a lot of attention on the effects and impact of Covid-19 on our daily lives and we are immersed in stories from all sectors, businesses, and the plight of the ordinary South African. Policymakers are tasked with reducing the spread of the disease and balancing this with negative economic impacts. There are pockets of data that may assist policy-makers in making timely decisions when faced with questions about intended recipients of the newly introduced Covid-19 SRD grant, also known as the R350 grant.

Fortunately, FinScope South Africa 2019 data could offer some indicators to aid decision-makers. FinScope 2019 reports 6.1 million adults (18 years and above) are vulnerable and/or unemployed and could likely be the first beneficiaries of Covid-19 SRD.

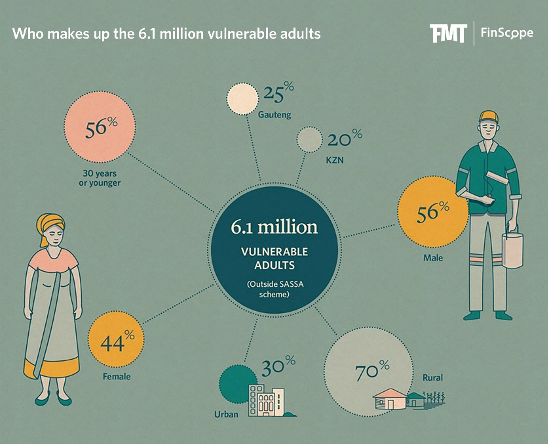

The data indicates that these are mostly male (56%) and young – under 30 years (56%). As a province Gauteng has the majority of the vulnerable with 25% – that is one in four are in Gauteng, followed closely by KwaZulu Natal (20%). Noting that 32% are from rural areas, and 38% are from small urban (non-metro areas), it begs the question of how the R350 will be distributed to them?

Again, FinScope has some clues. It shows that of the 6.1 million vulnerable adults, 60% do not have bank accounts – that is 3 703 257 adults. The lack of bank accounts can be overcome by using mobile money cash-send products available in the market, considering that 100% of the 6.1 million people have access to mobile phones. Of the 6.1 million people 64% have access to internet (and they access the internet via smartphones, computers, and other means). 64% of the 6.1 million have smartphones, and of this 79% use their smartphones to access internet, and 70% use WhatsApp.

Access to data, such as that collected in the FinScope South Africa 2019 survey, could be helpful in times of crisis to help policy-makers make informed decisions; such as more informed decisions about the number of potential beneficiaries and how to get grants to them during the current crises.

About FinScope Surveys:FinScope remains the most comprehensive demand-side instrument of its kind and has to date been conducted in over 36 countries. This places FinMark Trust in a unique position to support countries in SADC, West Africa, Asia and beyond, to understand their demand-side financial inclusion landscape. In South Africa, FinMark Trust is leading a syndicated approach to understand the impact of the pandemic on businesses through its on-going FinScope Small Business Survey 2020.

For more information about FinScope surveys and data contact Jabulani Khumalo and Abel Motsomi, both of whom are Senior Information and Research Specialists at FinMark Trust.