Long-distance running is something that Kenyan women excel at in the Olympics. Collectively, they have taken the second-most medals in the world at 4 - second only to the fellow African nation, Ethiopia at 10 - and twice as many as larger and wealthier countries, such as the United States. The road to the Olympics for a young woman in the country is fraught with hurdles, though. To unpack why, consider the hurdles a young woman who is an aspiring Olympic athlete must overcome, no matter where on the continent they are born.

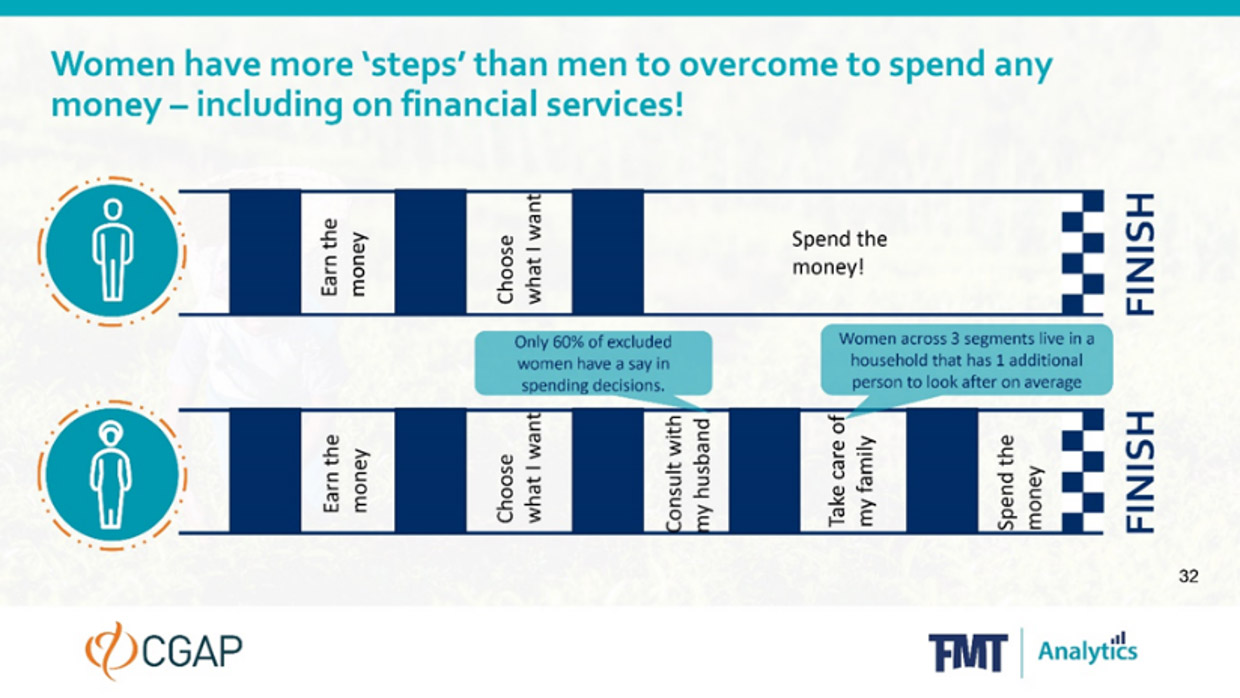

Joining an athletics team - and finding the money to support your competition is not easy. One way to secure this type of money, though, is through selling one's labour - or simply put, earning a wage - which is the first hurdle many young people in any of these countries must overcome. However, for young men, the race may well end here, and they simply have to determine how they spend their money. For young women, some additional hurdles remain.

Before starting to think about where they may want to spend their hard-earned income - women need to think of the household first. Their role as caregivers and tending to household items start at a young age - and qualitative research in both Kenya and South Africa substantiates this. In both countries, the burden placed on women to care for others first is higher than on men and their households have on average an additional mouth to feed compared to men.

After household expenses are taken care of, they must then convince their family members - parents, spouses and others before making a large commitment such as paying for a sporting club membership. In Kenya, only 60% of women have a say in large financial decisions in their household. In South Africa, this is (62)%. Men have near universal participation in household decisionmaking.

Not only are there additional socioeconomic hurdles for women to jump over before they can make financial decisions. The financial products they use - such as informal savings groups - are often viewed with suspicion by both FSPs and regulators alike. This is because there is potential for abuse - and because these funds are not intermediated or used in the formal economy, which is more efficient.

From the perspective of a young woman, they get more than a financial service to help them meet their goal from their informal savings group. They get a support network of friends and a flexible understanding environment that allows for individual circumstances where possible - all to help them meet their goals.

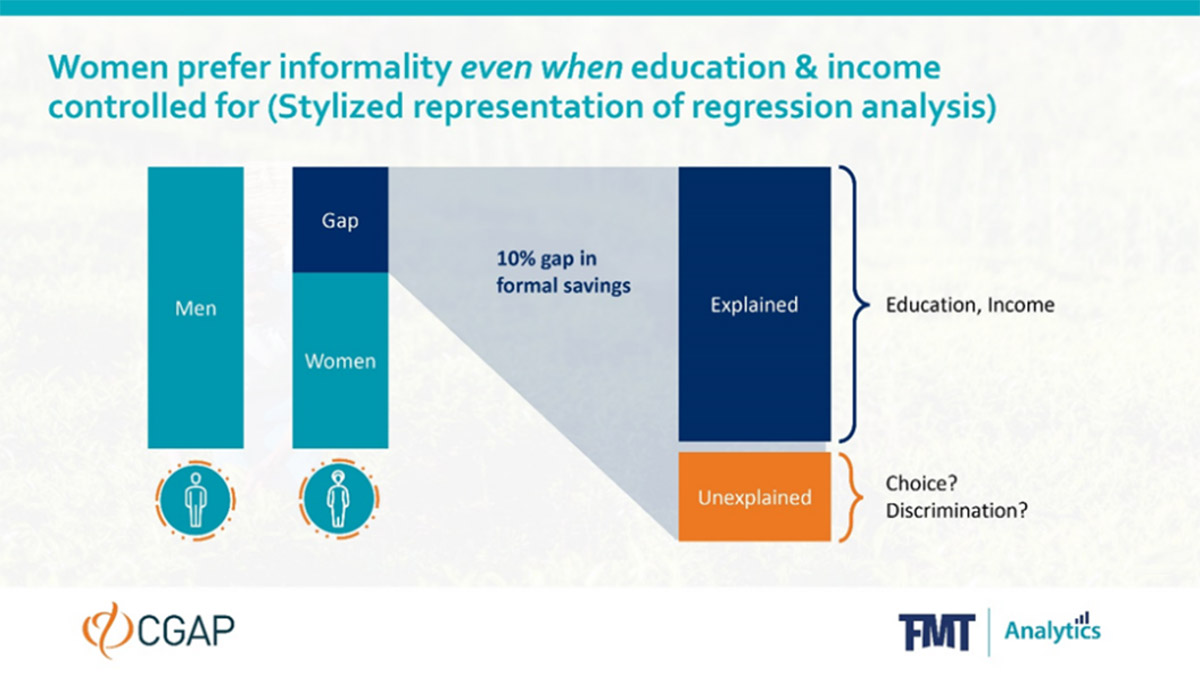

This is why even after income, education, and a host of other variables (*) are controlled for, a study commissioned by CGAP and implemented by FinMark Trust, found that women continue to prefer informal products. In other words - there is a preference for informality amongst women above that of men that does not relate to income, level of education, or other items.

The implications are important for a variety of financial services stakeholders. A tolerance of informality may be needed for policymakers and regulators, even though it goes against their best instincts. FSPs need to imagine how they digitize an entire community structure - not simply offering a product that many people can deposit into at once - which are commonplace across the continent.

For donors and NGOs, it focuses on addressing other hurdles women face at home first before looking to formal financial services to solve these and design their support and interventions accordingly.

Otherwise the current situation is likely to remain for women. To understand why - consider facing the long race ahead to a much desired financial purchase - such as a new pair of running shoes - only for it to be obscured by additional hurdles others do not face. The place you turn to is your local community, which has always been there for you for support and encouragement. You eagerly await your turn to get a payout from your local savings group - who had let you contribute flexibly in the past when you had to make household ends meet. Billboards are promoting the wonders of saving at the large local banks in the marketplace where you all meet - but you don't see them anymore. They are there for someone else and their dreams.