[UPDATE: After the publication of this article, CGAP released its Customer Analytics Toolkit: Driving Customer Centricity through Analytics. Readers may also find that publication useful.]

At insight2impact (i2i), we advocate for data-driven decision-making, and our research highlights some specific use cases for data in the financial services sector. However, if you are not already following a data-oriented business strategy, the world of data and analytics may seem overwhelming and it can be difficult to know where to start.

Aside from a range of online articles explaining how businesses can do more with data, two recently published handbooks offer practical advice specifically for financial services providers (FSPs). These resources are not published by i2i; we are sharing them to assist you in navigating the overwhelming volume of content published online.

The one, an International Finance Corporation (IFC) publication, focuses on digital FSPs and the other, produced by Accion, focuses on FSPs looking to drive financial inclusion. In addition to recommending a specific framework/tool for beginning a data project, both offer interesting examples of what finance companies in emerging markets are doing with data.

While the two tools differ, there are broad similarities in some of the steps they recommend FSPs follow:

- Begin with the real questions (what and why before how). Starting with the wider context, the business unit or team and the questions they need to answer or business problems they want to solve is the approach most likely to deliver value. The business goals can be translated into technical and functional requirements at a later stage.

- Determine what you have and what you need to acquire. In addition to identifying the data you already have (across various organisational silos), determine the hard and soft resources that are needed to begin extracting value from the data.

- Plan your process (and be prepared for the likelihood that you may need to change it).

- Start the work, but start small so that you can test your hypotheses and refine your approach and process. Warn your team that the first data-intensive task they do may be the unglamorous task of cleaning your data sets.

- Ensure that value is derived from the data strategy. There are numerous factors to consider in ensuring that you get valuable results from data-led decision-making. These include, but are not limited to:

- Building the operational capacity to respond to data and ensuring that data analysis is delivering actionable results and not insights for their own sake.

- Paying sufficient attention to data privacy and customer protection – this is particularly important in the financial sector.

- Aiming for customer-centricity – it can be tempting to collect more data than you need, but that may be off-putting to customers. Ideally, data insights should drive uptake and usage of your products and services.

While there is clearly no magic formula, these handbooks suggest working through a series of questions to determine the process that is most appropriate for your organisation.

In Unlocking the Promise of (Big) Data to Promote Financial Inclusion, the authors suggest, “Any organisation can begin its data journey by asking two simple questions: What is the process for making critical business decisions today? And, how would this process change if more data were available, or if the data currently available were better organised?”

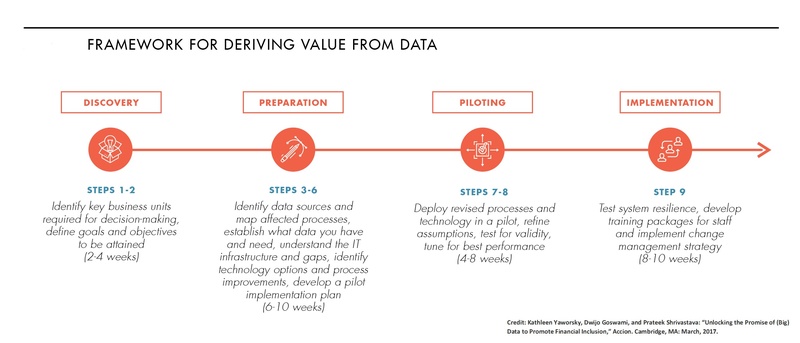

The framework that Accion proposes incorporates the following steps:

This framework could be a useful starting point for any financial organisation, not only those specifically focusing on data as a means to extend financial inclusion. Locating your organisation on the data continuum should be a first step and Accion emphasises that even small data can be used effectively to drive innovation.

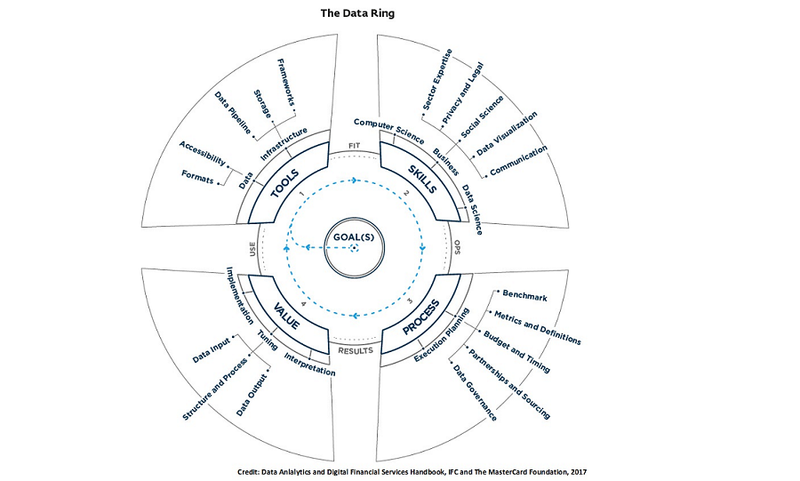

The data ring is a planning tool recommended by the IFC in its Data Analytics and Digital Financial Services Handbook. This tool encourages project managers to consider five overarching aspects and 10 subcomponents to better manage a data project.

Using a canvas approach, each component relates to a set of guiding framework questions, which can become a planning checklist. The circular design of the data ring is deliberate and is intended to remind users of the value of continuous improvement.

Look out for related content:

- The second article in this series on delving into data, where we will highlight some articles, reports and white papers that list a few lessons from those who have made headway on the data journey.

- The report on the results from the survey on the data maturity of FSPs in six African countries. The survey is being conducted in partnership with the Financial Sector Deepening Trusts in those countries. The results should be available by mid-November 2017.

We plan to share external content on a regular basis. Please let Karen Kühlcke at karen@i2ifacility.org know what you would find useful (specific topics or types of content) in your role in the financial sector. Karen is the content curator for the i2i facility.

Please note that sharing external content and links to publications that are not authored by i2i does not constitute official endorsement of the contents thereof.